Most major indices ended the week lower with a sharp decline in the Nasdaq 100, but the Dow 30 Industrials ended virtually unchanged. Traders now seem to be taking the likelihood of higher rates for longer seriously. Artificial intelligence stocks sold off sharply on Friday after one of the AI stocks with large gains this year announced the next release date for earnings but did not make a preannouncement like they did the previous quarter. In the previous quarter, the company pre-announced some stellar figures, and without that traders decided to take profits. Also weighing on markets were geopolitical risks with Iran’s large drone and missile attack on Israel. 99% of the missiles and drones were intercepted by Israel mainly with the help of the U.S., the U.K. and Jordan. Concerns persisted about Israel’s counter strike on Iran, but this ended up being smaller than expected and based on comments from Iran, the risk of escalation has diminished for now.

1st quarter earnings announcements are now coming in, with many major technology stocks due to report next week.

The International Monetary Fund made an unusual criticism of the U.S. fiscal policy that is out of line with long term sustainability. While the U.S. ended 2023 with fiscal debt equal to 97% of gross domestic product it is projected to grow to 114% of GDP by the end of 2033. That would be greater than following World War II. Still, that is far below Japan’s 263% debt to GDP ratio. Although over 43% of Japan’s debt is owned by the central bank.

Treasury bond yields rose with the 30-year bond yield at 4.725% and the 10-Year note at 4.630%. Freddie Mac reported that the average 30-year mortgage rate rose to 7.1%. Crude oil fell to $83.20 a barrel and natural gas rose to $1.789 per MMBTUs. The U.S. dollar index fell to 105.78 and gold rose to $2403.40 an ounce.

In economic reports this week:

- The International Monetary Fund upgraded its estimate for global growth in 2024 from 3.1% to 3.2%.

- The National Association of Realtors reported that existing home sales fell 4.3% in the month of March and were down 3.7% from last March.

- Inventory levels of unsold home rose from a 2.9-month supply to a 3.1-month supply.

- The median price of a new home sale was $393,500 up 4.8% from $375,300 a year ago.

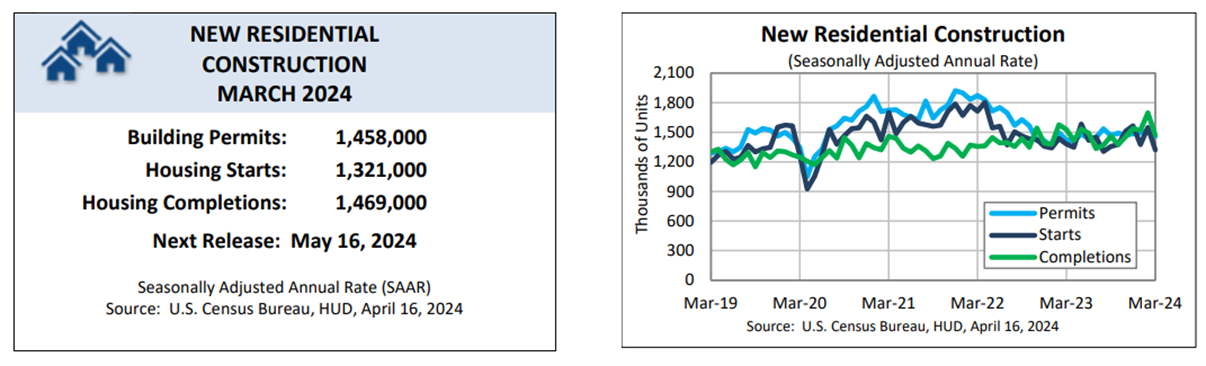

- The Commerce Department reported:

-

-

- Permits, an indication of future housing starts fell 4.3% in March but are up 1.5% from last March.

-

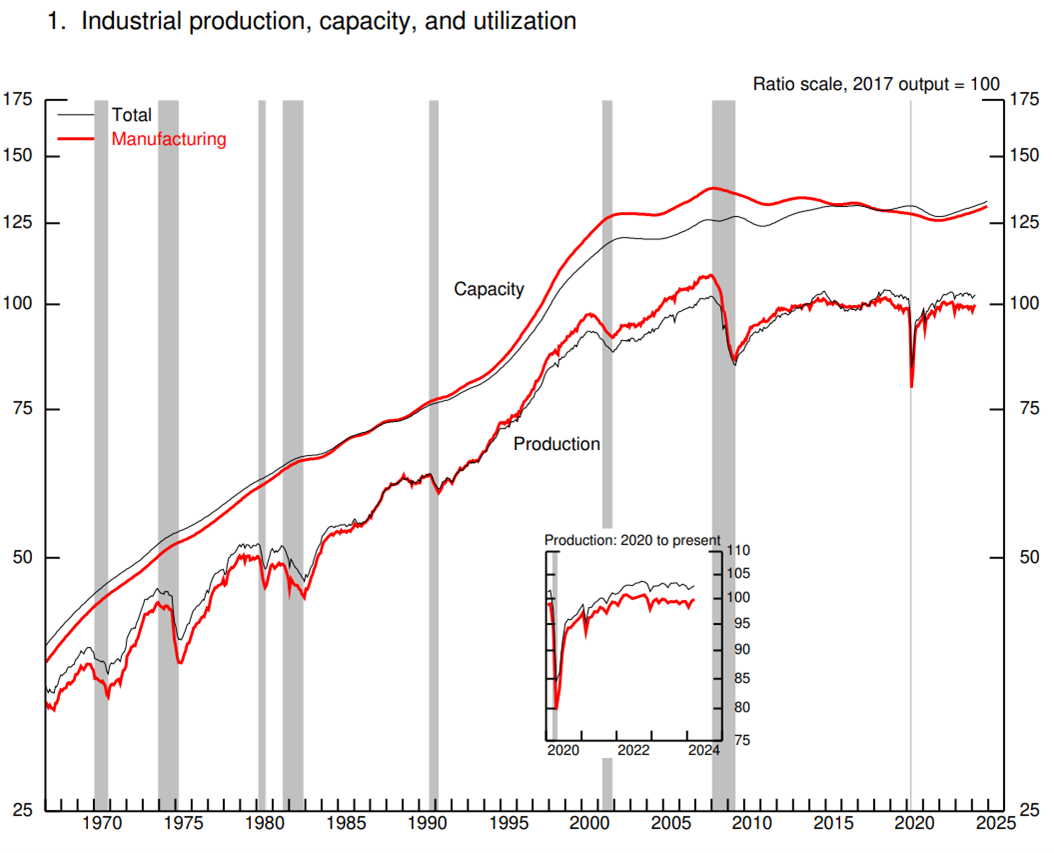

- The Federal Reserve reported that industrial production rose 0.4% in March, following a 0.4% increase in February.

Source: Federal Reserve

- The Labor Department reported:

- Seasonally adjusted first-time claims for unemployment were 212,000, unchanged from the previous week’s revised level.

- The 4-week moving average of claims, designed to smooth out volatility, was 214,500, unchanged from the previous week’s revised level.

- For the full unemployment report go here: https://www.dol.gov/ui/data.pdf .

- Seasonally adjusted first-time claims for unemployment were 212,000, unchanged from the previous week’s revised level.

- The EIA weekly oil report is here: http://ir.eia.gov/wpsr/wpsrsummary.pdf . Also, the EIA reported in the prior week:

- Field production of crude oil was unchanged at 13.1MM BPD.

- Natural gas storage rose 50BN cubic feet and was above the highest level during the past five years at this time of year.

- Baker Hughes reported the number of oil rigs were 511 and the number of natural gas rigs were 106.

- Factset reported that with 14% of S&P 500 companies reporting, the blended earnings increase so far is 3.4% from a year ago.

Please call us if you have any questions.

Loren Rex – Emeritus

Erik A Smith, AIF® – President & C.E.O.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. The Indices mentioned are unmanaged and cannot be invested into directly. The Dow Jones Industrial Average, Dow Jones, or simply the Dow, is a stock market index of 30 prominent companies listed on stock exchanges in the United States. The DJIA is one of the oldest and most commonly followed equity indexes. The Nasdaq Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange (more than 2500 stocks).

Sources:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

https://ir.eia.gov/ngs/ngs.html

https://www.freddiemac.com/pmms

https://www.wsj.com/market-data?mod=nav_top_subsection

https://bakerhughesrigcount.gcs-web.com/na-rig-count

https://www.census.gov/economic-indicators

https://www.federalreserve.gov/releases/g17/current/default.htm

https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales