Most major stock indices ended the week higher with the exception of the small cap Russell 2000. The same was true for the month of April. Traders took their cues on first quarter earnings announcements with several large tech companies posting large upside surprises.

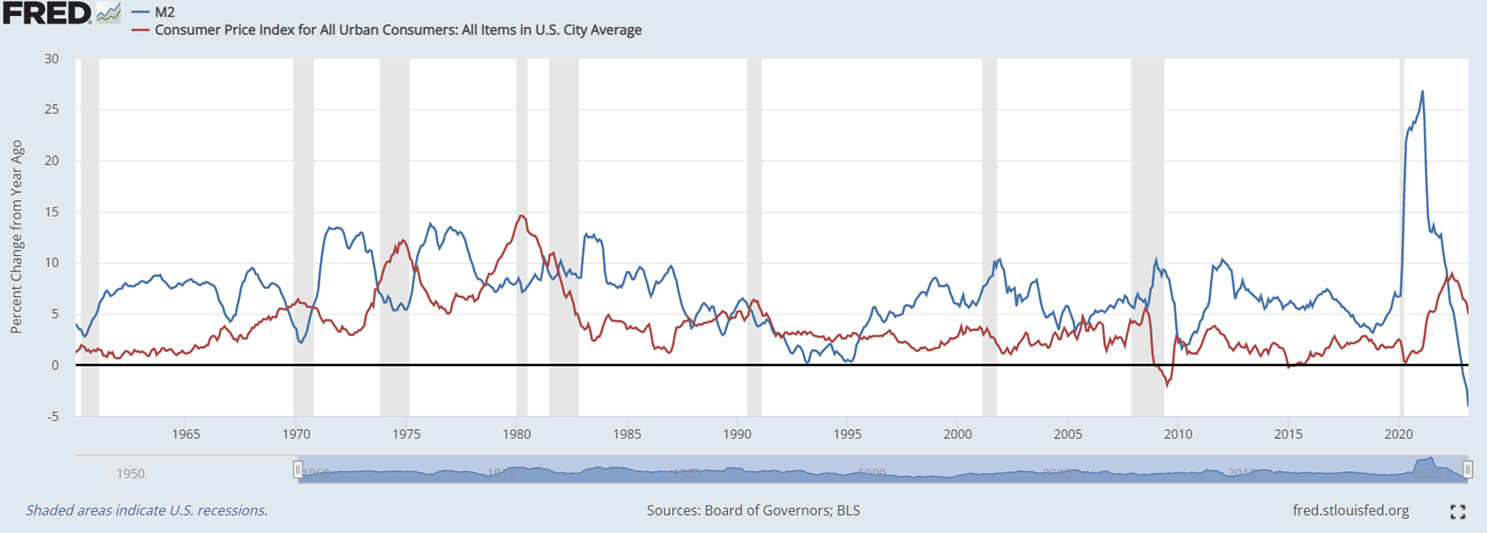

In the economic front, first quarter gross domestic product rose less than expected. March personal consumption expenditures and lower PCE price increases raised hopes of fewer FED rate hikes. However, strong new home sales, durable goods orders and pay increases may cause the FED to hike further when it meets next week. Although the Fed’s measure of M2 money supply has contracted from a year ago following a large increase from 2020 into 2021, which may build a case for pausing rate hikes.

Treasury bond yields fell with the 30-year bond yield at 3.676% and the 10-Year note at 3.429%. Freddie Mac reported that 30-year mortgage rates rose to 6.43%. Crude oil fell to $76.77 a barrel and natural gas rose to $2.573 per MMBTUs. The U.S. dollar index fell to 101.67 and gold rose to $1997.80 an ounce.

- The S&P CoreLogic Case-Shiller National Home Price Index rose 0.2% in February and 2.0% from a year earlier.

- This was the first monthly increase since July 2022 and was the smallest year over year increase since July 2012.

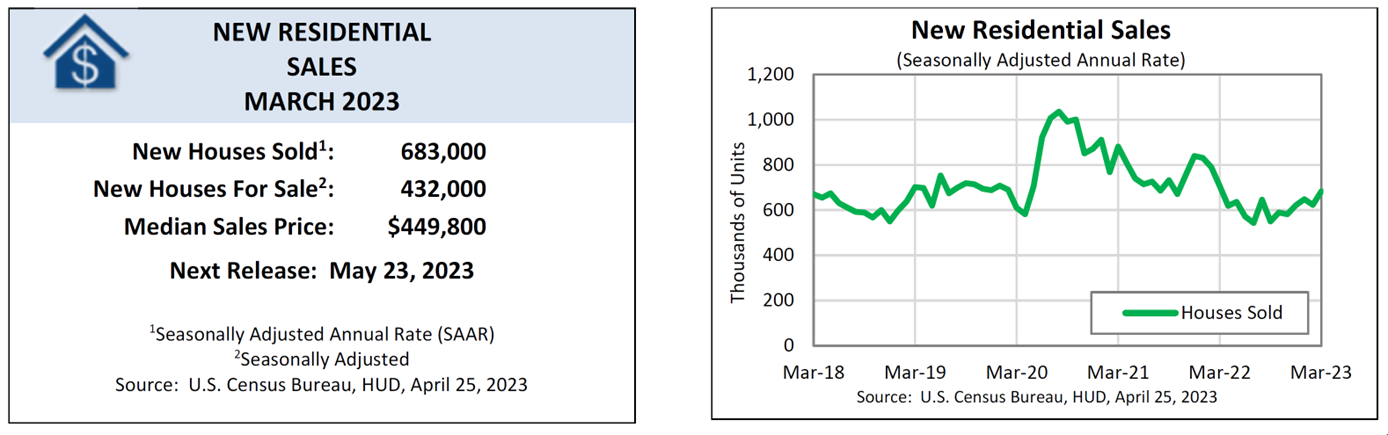

- The Commerce Department reported:

-

- Gross domestic product grew at an inflation adjusted 1.1% annual rate in the first quarter, down from 2.6% in the fourth quarter.

- Consumer spending, exports, federal government spending, state and local government spending, and nonresidential fixed investment increased.

- Private inventory investment and residential fixed investment decreased and imports rose, which are subtracted from GDP.

- Personal consumption expenditures (PCE) were unchanged in March.

- PCE Price index rose 0.1% in March and 4.2% from a year ago. This was down from 5.1% year over year in February. This is the FED’s preferred measure of inflation.

- Excluding volatile food and energy the PCE price index rose 0.3% in March and 4.6% from a year ago.

- Personal incomes rose 0.3% in March.

- The personal savings rate was 5.1%.

- Gross domestic product grew at an inflation adjusted 1.1% annual rate in the first quarter, down from 2.6% in the fourth quarter.

- The Federal Reserve reported that the M2 money supply has contracted from a year ago:

- The Labor Department reported:

- The labor cost index rose 1.2% in the first quarter and 4.8% from a year ago.

- Seasonally adjusted first-time claims for unemployment were 230,000 down from a revised 246,000 in the prior week..

-

-

- The 4-week moving average of claims, designed to smooth out volatility, was 236,000 down from a revised 240,000 in the prior week.

- For the full unemployment report go here: https://www.dol.gov/ui/data.pdf .

-

- The EIA weekly oil report is here: http://ir.eia.gov/wpsr/wpsrsummary.pdf . Also, the EIA reported in the prior week:

- Field production of crude oil fell from 12.3MM BPD to 12.2MM BPD.

- Natural gas storage rose 79BN cubic feet and is above the 5-year average at this time of year.

- Baker Hughes reported the number of active oil rigs was unchanged at 591. The number of active natural gas rigs rose 2 to 161.

- Factset reported that with 53% of S&P 500 companies reporting earnings, the blended earnings decrease was 3.7% from a year ago.

Please call us if you have any questions.

Loren C. Rex, CFP®, MA Erik A Smith, AIF®

Founder / Emeritus President & C.E.O.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. The Indices mentioned are unmanaged and cannot be invested into directly.

Sources:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

https://www.freddiemac.com/pmms

https://www.factset.com/earningsinsight

https://www.wsj.com/market-data?mod=nav_top_subsection

https://bakerhughesrigcount.gcs-web.com/na-rig-count

https://www.census.gov/economic-indicators/#home_sales

https://www.census.gov/manufacturing/m3/adv/pdf/durgd.pdf

https://www.bea.gov/news/2023/personal-income-and-outlays-March-2023