Stocks rose again this week with the largest gains in the tech heavy Nasdaq index. The Federal Reserve met and decided to skip a rate hike at this meeting but stressed this is not the end of rate hikes. The average prediction from FED members calls for two more rate hikes this year with a hike likely at the July meeting. However, that depends on incoming data.

The ECB met and raised the benchmark interest rate to 3.5% and indicated another hike was likely in July.

The People’s Bank of China lowered its 7 day reverse repurchase interest rate from 2.0% to 1.9%. The medium term lending rate was cut from 2.75% to 2.65%. China also announced plans for major stimulus spending as China has been experiencing a slow recovery from Covid Zero and has very low inflation.

Treasury bond yields were mixed with the 30-year bond yield at 3.854% and the 10-Year note at 3.767%. Freddie Mac reported that 30-year mortgage rates fell to 6.69%. Crude oil rose to $71.71 a barrel and natural gas rose to $2.619 per MMBTUs. The U.S. dollar index fell to 102.32 and gold fell to $1968.50 an ounce.

- The Federal Reserve reported that industrial production fell 0.2% in May.

- Manufacturing fell 0.3%.

- Mining, including oil and gas production, rose 5.0%

- Utility production fell 3.8%.

- The Commerce Department reported:

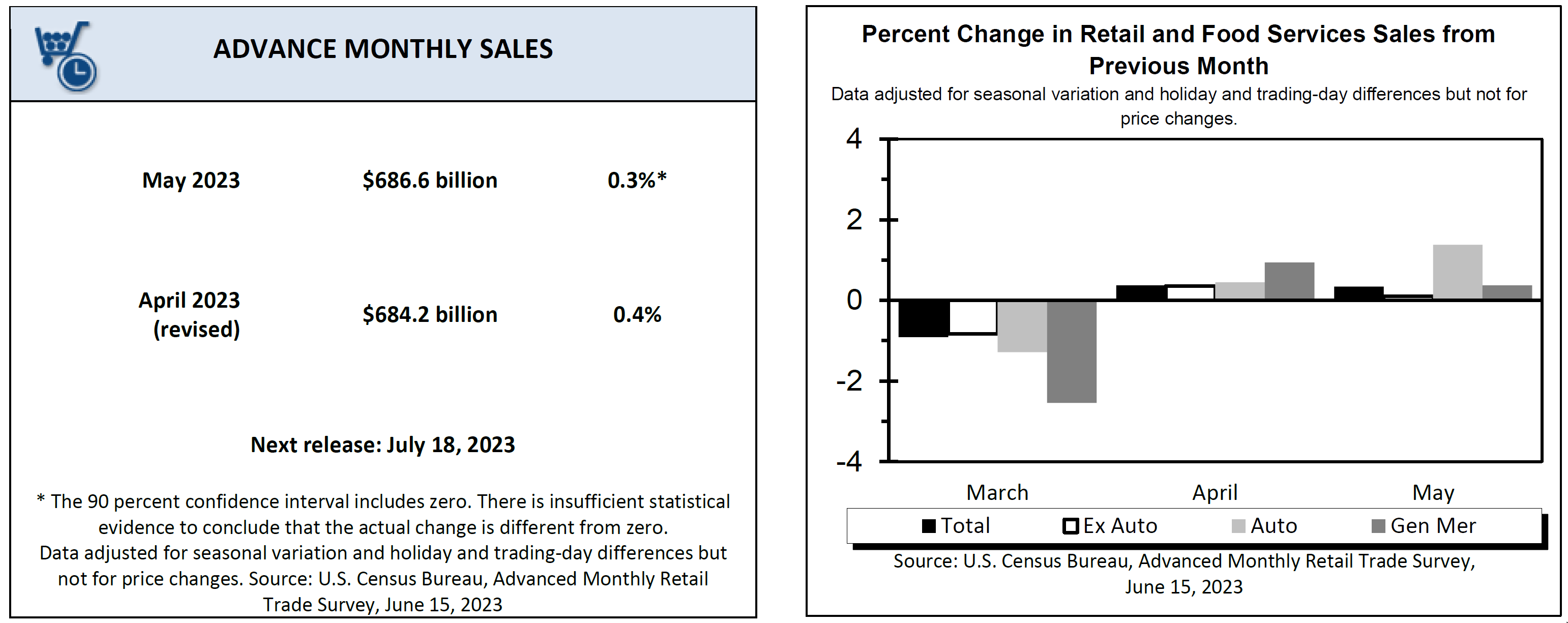

- Seasonally adjusted retail sales rose 0.3% in May, down from a revised 0.4% gain in March. Retail sales are not adjusted for inflation.

- From a year earlier, retail sales have risen 1.6%, a negative considering inflation.

- The Labor Department reported:

- Consumer prices rose 0.1% in May, down from a 0.4% increase in April.

- From a year ago, consumer prices have risen 4.0%, the lowest level since March 2021, and less than half from last year’s peak.

- Core prices, excluding volatile food and energy, rose 0.4% in May and are up 5.3% from a year earlier.

- Used cars and trucks rose 4.4% in the month of May.

- Energy fell 3.6% in May.

- Producer prices fell 0.3% in May.

- Goods prices fell 1.6%.

- Services prices rose 0.2%.

- Seasonally adjusted first-time claims for unemployment was 262,000 unchanged from the previous week’s revised level.

- The 4-week moving average of claims, designed to smooth out volatility, was 246,750 an increase of 9250 from the previous week’s revised level.

- Consumer prices rose 0.1% in May, down from a 0.4% increase in April.

-

-

- For the full unemployment report go here: https://www.dol.gov/ui/data.pdf .

-

- The EIA weekly oil report is here: http://ir.eia.gov/wpsr/wpsrsummary.pdf . Also, the EIA reported in the prior week:

- Field production of crude oil was unchanged at 12.4MM BPD.

- Natural gas storage rose 84BN cubic feet and is above the 5-year average at this time of year.

- Baker Hughes reported the number of active oil rigs fell 4 to 552. The number of active natural gas rigs fell 5 to 130.

Please call us if you have any questions.

Loren C. Rex, CFP®, MA Erik A Smith, AIF®

Founder / Emeritus President & C.E.O.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. The Indices mentioned are unmanaged and cannot be invested into directly.

Sources:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

https://ir.eia.gov/ngs/ngs.html

https://www.freddiemac.com/pmms

https://www.wsj.com/market-data?mod=nav_top_subsection

https://bakerhughesrigcount.gcs-web.com/na-rig-count

https://www.ecb.europa.eu/stats/policy_and_exchange_rates/key_ecb_interest_rates/html/index.en.html