U.S. and global stocks saw substantial losses as global growth worries dampened investor sentiment. Events on Thursday and Friday drove the selloff:

On Thursday, the European Central Bank, that just ended its €2.9TN bond buying program less than three months ago, reversed course and announced new stimulus. While extending the current ultra-low interest rates, the ECB also announced new low interest long term loans for banks. Europe has been feeling the brunt of the global slowdown as Italy has slipped into recession, France has slowed dramatically due to protests and Germany, the Eurozone’s largest economy, has slowed due to automotive manufacturing bottlenecks. The ECB forecast only 1.1% growth in 2019. The Eurozone’s inflation rate slowed to 1.5% in the latest reading allowing for more simulative measures. The ECB’s stimulus coupled with huge stimulus in China are meant to stem a global slowdown.

On Friday, the Labor Department reported that a surprisingly small number of jobs were created in February. Also, China reported a very sharp drop in exports in February.

We believe the jobs number needs to be taken with a large grain of salt. We had stellar jobs numbers in December and January with January revised up to 311,000. Also, the private ADP jobs number grew 183,000 in February casting some doubt on the 20,000 figure. We see a sharp increase in the U.S. services PMI and a manufacturing PMI above 50 indicates the economy is still expanding. However, a slowdown in hiring was expected following the unusually strong December and January numbers and the challenge of businesses finding qualified candidates. Barring unforeseen circumstances, we expect the numbers to improve in future months.

Not helping the markets were reports that China is balking at setting up a summit on trade until a firm deal has been reached. Based on the failed North Korea summit, China is concerned that President Trump will add more demands at the summit and wants it to be a signing ceremony not a negotiating session.

Friday’s selloff recovered by the end of the session perhaps on the silver lining that weaker jobs numbers lessen the probability of any more FED rate hikes.

In the numbers this week:

- The Organization for Economic Cooperation and Development lowered its forecast for 2019 global growth from 2.7% to 2.6%.

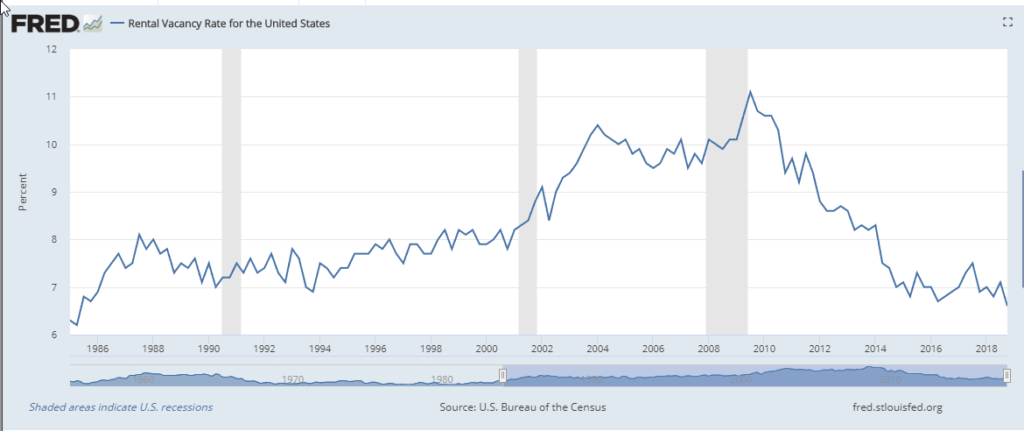

- The Federal Reserve reported that the rental vacancy rate is the lowest since 1985.

- The Institute for Supply Management reported that the non-manufacturing purchasing managers index rose to 59.7 in March, from 56.7 in January, indicating a sharp acceleration in the services sector.

- Canada reported

- Adding 55,900 new jobs in February but the unemployment rate was unchanged at 5.8% due to more people entering the workforce.

- Wages in February increased at a 2.3% annual pace.

- China reported that exports in February fell 20.7% from February of last year. This follows a 9.1% increase in January. China’s trade surplus with the U.S. fell to $14.72BN in February, the lowest in two years.

- The Commerce Department reported:

- New home sales rose 3.7% in December from November. However, December sales were down 2.4% from December 2017.

- The U.S. Trade deficit including both goods and services rose 10% in 2018. Exports rose but imports rose faster due to the growing U.S. economy.

- Housing starts rose 18.6% in January. Single family housing starts rose 25.1% and multi-family starts rose 4%. Single family starts were aided by the end of the government shutdown and lower mortgage rates.

- Single family housing permits, an indicator of future housing starts, fell 2.1% while multi-family housing permits rose 4.0%.

- The Labor Department reported:

- First time claims for unemployment fell 3,000 to a seasonally adjusted 223,000. The four week moving average of claims fell 3,000 to a seasonally adjusted 226,250.

- Productivity grew at a 1.9% annual rate in the 4th quarter. Gains in productivity allow for wage increases without igniting inflation.

- The U.S. created only 20,000 jobs in February. However, December and January jobs numbers were revised up with January hitting 311,000 jobs. Employers are finding it difficult to fill positions with adequate skills.

- Unemployment fell to 3.8% from 4.0% indicating that the U.S. is at full employment.

- The labor force participation rate, the percentage of working age Americans is at 63.2% up from 62.4 in September 2015 as more people are entering the workforce.

- The Energy Information Administration weekly report is here wpsrsummary. Also, the EIA reported:

-

- U.S. Crude oil production remained unchanged at 12.1MM barrels per day.

- Storage of natural gas fell 149BN cubic feet. Natural gas storage is above the past five year minimum for this time of year.

- Baker Hughes reported in the past week that the number of active oil rigs fell 9 to 834 and the number of active gas rigs fell 2 to 193.

Please call us if you have any questions.

Best Regards,

Loren C. Rex, CFP®, AIF®, MA Erik A Smith

President Managing Partner

Generations Financial Planning & Wealth Management 269-441-4143

77 E. Michigan Ave, Suite 140

Battle Creek, MI 49017

Tel 269-441-4090

Carrie Fuce, Assistant 269-441-4091

Toll Free: 800-513-8180

Fax 866-381-2301

Visit our Website: www.genfinplan.com

Registered Representative of and securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Generations Financial Planning & Wealth Management are separate companies and are not affiliated.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. The Indices mentioned are unmanaged and cannot be invested into directly.

Blog Post

Weekly Market Commentary

U.S. and global stocks saw substantial losses as global growth worries dampened investor sentiment. Events on Thursday and Friday drove the selloff:

On Thursday, the European Central Bank, that just ended its €2.9TN bond buying program less than three months ago, reversed course and announced new stimulus. While extending the current ultra-low interest rates, the ECB also announced new low interest long term loans for banks. Europe has been feeling the brunt of the global slowdown as Italy has slipped into recession, France has slowed dramatically due to protests and Germany, the Eurozone’s largest economy, has slowed due to automotive manufacturing bottlenecks. The ECB forecast only 1.1% growth in 2019. The Eurozone’s inflation rate slowed to 1.5% in the latest reading allowing for more simulative measures. The ECB’s stimulus coupled with huge stimulus in China are meant to stem a global slowdown.

On Friday, the Labor Department reported that a surprisingly small number of jobs were created in February. Also, China reported a very sharp drop in exports in February.

We believe the jobs number needs to be taken with a large grain of salt. We had stellar jobs numbers in December and January with January revised up to 311,000. Also, the private ADP jobs number grew 183,000 in February casting some doubt on the 20,000 figure. We see a sharp increase in the U.S. services PMI and a manufacturing PMI above 50 indicates the economy is still expanding. However, a slowdown in hiring was expected following the unusually strong December and January numbers and the challenge of businesses finding qualified candidates. Barring unforeseen circumstances, we expect the numbers to improve in future months.

Not helping the markets were reports that China is balking at setting up a summit on trade until a firm deal has been reached. Based on the failed North Korea summit, China is concerned that President Trump will add more demands at the summit and wants it to be a signing ceremony not a negotiating session.

Friday’s selloff recovered by the end of the session perhaps on the silver lining that weaker jobs numbers lessen the probability of any more FED rate hikes.

In the numbers this week:

Please call us if you have any questions.

Best Regards,

Loren C. Rex, CFP®, AIF®, MA Erik A Smith

President Managing Partner

Generations Financial Planning & Wealth Management 269-441-4143

77 E. Michigan Ave, Suite 140

Battle Creek, MI 49017

Tel 269-441-4090

Carrie Fuce, Assistant 269-441-4091

Toll Free: 800-513-8180

Fax 866-381-2301

Visit our Website: www.genfinplan.com

Registered Representative of and securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Generations Financial Planning & Wealth Management are separate companies and are not affiliated.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. The Indices mentioned are unmanaged and cannot be invested into directly.

RESERVE A CONFIDENTIAL DISCUSSION NOW

Recent Posts