Stocks advanced this week based on better than expected economic data capped off by a strong February jobs report on Friday. Further talks between OPEC members and Russia on freezing production levels of oil sparked a rally in crude oil prices despite the fact that no deal has been reached. While crude oil production in the U.S. has fallen since April of last year, stockpiles in the U.S. continue to rise. In some cases rail cars are being used simply for storage. This coming week there will be a European Central Bank monetary meeting which will be very telling regarding the direction of stimulus in Europe. In particular this week:

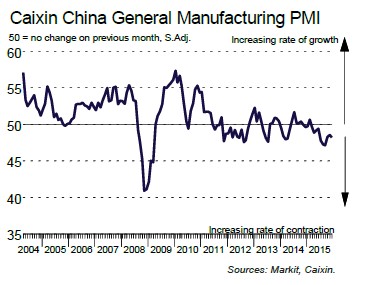

- The Caixin China manufacturing purchasing managers’ index fell to 48.0 in February from 48.4 in January as the decline in Chinese manufacturing accelerated.

- The Energy Information Administration reported that crude oil inventories rose 10.4 MM barrels in the past week despite the fact that production of crude oil in the U.S. has fallen from 9.7MM barrels per day last April to 9.1MM barrels per day. With expected seasonal refinery maintenance coming this spring the inventory situation will likely get worse.

- According to Reuters U.S. Auto Sales rose 8% in February.

- The Institute for Supply Management reported:

- S. Manufacturing purchasing managers’ index rose in February to 49.5 from 48.2 in January. Keep in mind that anything less than 50 represents contraction but a higher number indicates manufacturing declined at a slower pace. This is the fifth month in a row of contraction in U.S. manufacturing.

- S. Non-manufacturing purchasing managers’ index fell to 53.4 in February from 53.5 in January. Anything over 50 represents expansion, just at a slower pace.

- The Labor Department reported:

- First time claims for unemployment rose in the prior week 6,000 to 278,000. The four week moving average of claims, however, fell 1,750 to 270,250.

- Productivity of non-farm workers fell a seasonally adjusted annual rate of 2.2%. Output rose 1% and hours worked rose 3.2%. The 2.2% decline was less than the 3% previously estimated. Productivity declines usually occur when businesses add new workers due to training and the learning curve. Although weakness in demand or reduced capital spending can also negatively affect productivity. Productivity in the fourth quarter was 0.5% higher than a year ago.

- The U.S. added 242,000 jobs in February, much more than forecast. The unemployment rate remained unchanged at 4.9%. Wages fell 0.1%. However, this came on the heels of a 0.5% increase in January.

Please call us if you have any questions.

Best Regards,

Loren C. Rex, CFP®, AIF® Erik Smith

President Partner

Generations Financial Planning & Wealth Management 269-441-4143

77 E. Michigan Ave, Suite 140

Battle Creek, MI 49017

Tel 269-441-4090

Carrie Fuce, Assistant 269-441-4091

Toll Free: 800-513-8180

Fax 269-441-4093

Visit our Website: www.genfinplan.com

Registered Representative of and securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Generations Financial Planning & Wealth Management are separate companies and are not affiliated.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice.

Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results