U.S. stocks slid early in the week but rallied on Friday after a much better than expected jobs number posting a gain for the week. U.S. Treasury yields also rose after the strong jobs number increased speculation of another FED rate increase this year. Commodity prices fell and the dollar rose against a basket of currencies. The U.K. announced an interest rate cut and increased stimulus to help offset the slowdown following the Brexit vote.

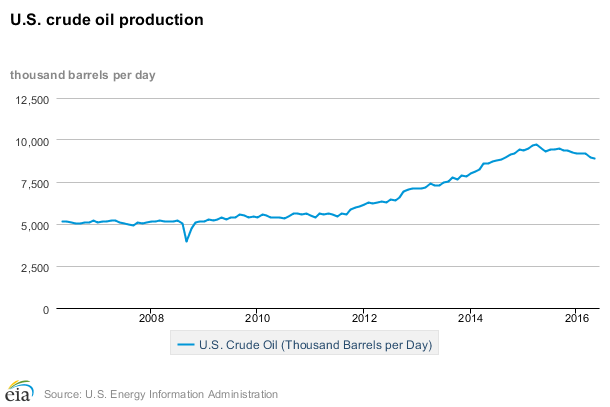

Looking at energy, U.S. production of crude oil is declining dramatically from its peak last year due to strong production from low cost overseas producers and a worldwide glut of crude. This past week, gasoline inventories fell due to refinery maintenance but crude oil inventories rose. Expectations are that Nigerian and Libyan production will start ramping up soon. Russian year over year exports have increased for each of the past 24 months.

In the numbers this week.

- According to Factset with 86% of S&P500 companies reporting, the blended earnings decline is 3.5% in Q2.

- The private Caixin China manufacturing index came in at 50.6 in July after hitting 48.6 in June. The figure being over 50 represents expansion after 15 months of contraction.

- The Institute for Supply Management reported

- The U.S ISM Manufacturing Index fell to 52.6 in July from 53.2 in June.

- The U.S. ISM Non-Manufacturing Index fell to 55.5 in July from 56.6 in June. Both indexes are still expanding, but at a slower pace.

- The Commerce Department reported:

- Personal consumption rose 0.4% in June, following a 0.4% increase in May and a 0.1% increase in April.

- Personal Income rose 0.2%.

- The Federal Reserve reported

- The personal-consumption price index rose 0.4% in June and only 0.9% from a year ago, much less than its inflation target of 2%.

- Core prices, excluding volatile food and energy, also rose 0.1% in June and 1.6% from a year ago.

- The Labor Department reported first time claims for unemployment rose 3,000 to a seasonally adjusted 269,000. The four week moving average of claims rose 3,750 to 256,500.

- The U.S. Energy Information Administration reported in the prior week:

- Crude oil inventories rose 1.4MM barrels.

- Crude oil production fell 55,000 barrels.

- Gasoline inventories fell 3.3MM barrels.

- Baker Hughes reported that the US oil drilling rig count rose 7 to 381, the sixth straight week of oil rig increases while gas rigs fell 5 to 81.

- The Labor department reported:

- First time claims for unemployment in the prior week rose 3,000 to 269,000. The four week moving average of claims was 260,250 an increase of 3,750.

- The U.S. added 255,000 jobs on July, much better than expectations. The unemployment rate remained at 4.9% as more people entered the workforce.

Please call us if you have any questions.

Best Regards,

Loren C. Rex, CFP®, AIF® Erik Smith

President Partner

Generations Financial Planning & Wealth Management 269-441-4143

77 E. Michigan Ave, Suite 140

Battle Creek, MI 49017

Tel 269-441-4090

Carrie Fuce, Assistant 269-441-4091

Toll Free: 800-513-8180

Fax 269-441-4093

Visit our Website: www.genfinplan.com

Registered Representative of and securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Generations Financial Planning & Wealth Management are separate companies and are not affiliated.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice.