The consumer-price index, CPI, reached a 41 year high of 1.3% in June and 9.1% from a year ago. However, there are signs of inflation may be easing in July with a decline in gas prices. Markets declined after the release of the CPI over fears that the FED may hike short term rates a full percentage point at their next meeting but a couple of FED governors commented that 0.75% is more likely. This and strong retail spending and bank earnings drove a strong rally on Friday. Still, major stock indices ended the week with minor losses.

With the strengthening of the dollar, the Euro reached parity with the U.S. dollar, it’s lowest value since 2002. The Euro was equal to $1.22 U.S. on October 1, 2020.

Treasury yields fell with the 30-year bond yield at 3.088% and the 10-Year note at 2.922%. Mortgage rates rose with the 30-year mortgage rate ending at 5.92%. U.S. crude oil fell to $97.32 a barrel and natural gas rose to $7.02 per MMBTUs. The U.S. dollar index rose to 108.06. Gold fell to $1703.20 an ounce.

In the economic numbers:

- Redfin reported that the percentage of sale agreements on existing homes that have been canceled reached 15% in June, the highest since early in the pandemic.

- Marine Traffic reported that over $31BN in trade is landlocked or stuck anchored off U.S. ports. This may be made worse by an impending rail strike.

- The U.K. economy grew 0.5% in the month of May after declining in March and April.

- China reported:

- Gross domestic product rose 0.4% in the second quarter of 2022 from the second quarter of 2021.

- Retail sales rose 3.1% from a year earlier.

- Property investment fell 9.4% from a year ago.

- The Commerce Department reported:

- Retail spending rose 1.0% in June following a 0.1% decline in May. This is adjusted for seasonal fluctuations but not for inflation.

- Sales of furniture, gasoline and groceries rose.

- Sales fell at building supply, clothing and department stores.

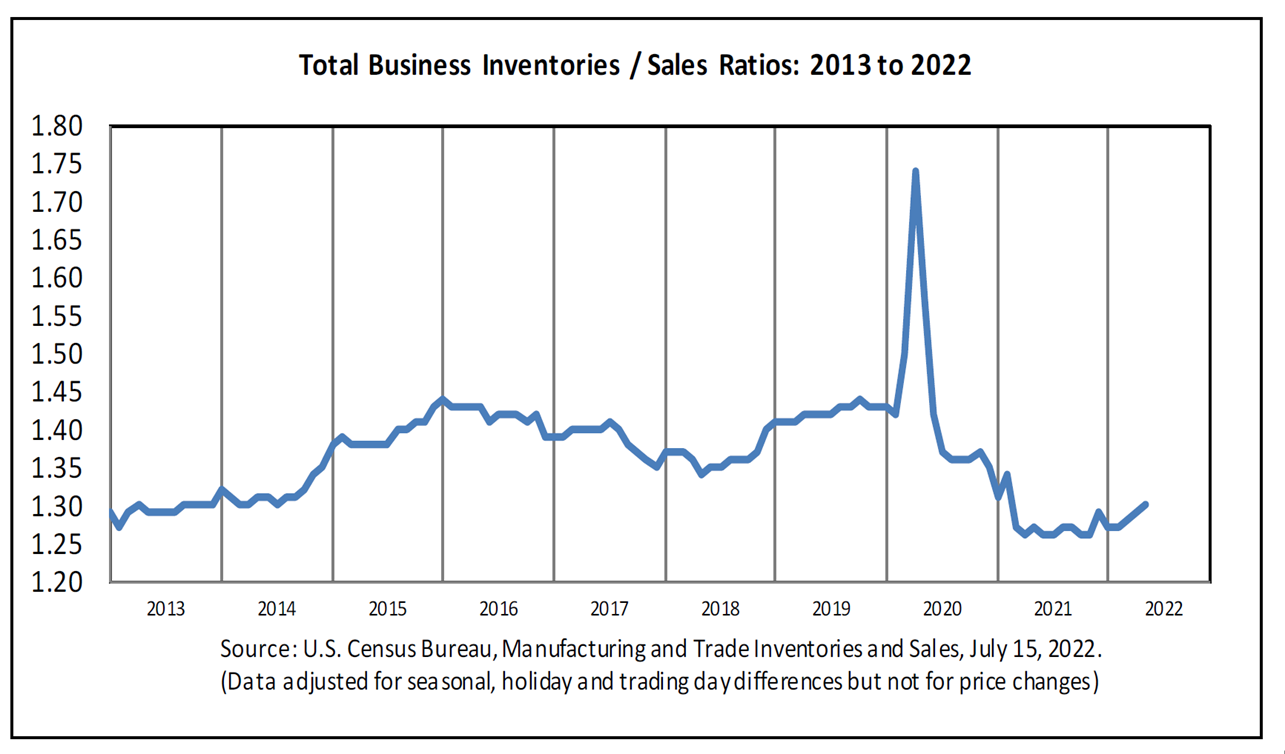

- Business inventories rose 1.4% in May, following a 1.3% increase in April. Still inventories remain below pre-pandemic levels.

- Retail spending rose 1.0% in June following a 0.1% decline in May. This is adjusted for seasonal fluctuations but not for inflation.

- The Federal Reserve reported that industrial production fell 0.2% in the month of June, following a revised zero change in May.

- Manufacturing declined 0.5%.

- Mining, including oil and gas production rose 0.8%.

- Utility production rose 1.4%.

- From June of 2021, total industrial production has risen 4.2%.

- The Labor Department reported:

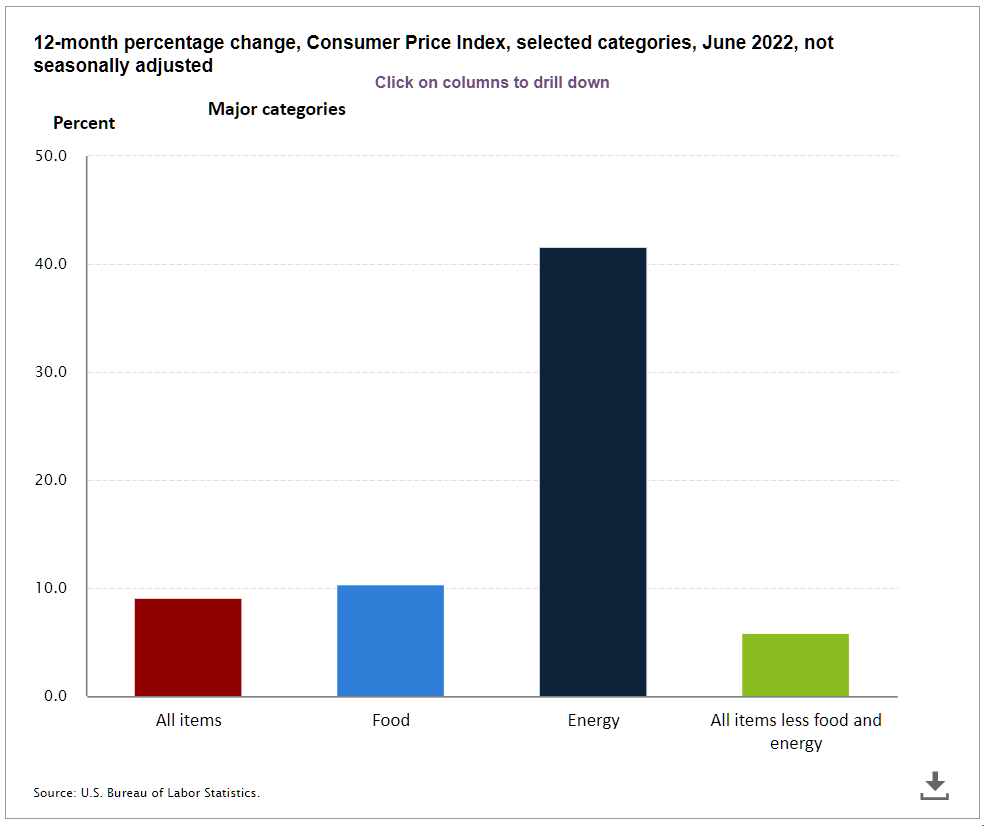

- The consumer-price index rose 1.3% in the month of June.

- From a year earlier prices rose 9.1% from 8.6% in May. This was the highest in 41 years.

-

- The producer-price index rose 1.1% in the month of June and 11.3% from a year earlier.

- Excluding volatile food, energy and trade services, producer prices rose 0.3% in June and 6.4% from a year ago.

- Seasonally adjusted first time claims for unemployment rose to 244,000, up from a revised 235,000 in the prior week. This was the highest since November.

- The 4-week moving average of claims, designed to smooth out volatility, rose to 235,750.

- For the full unemployment report go here: https://www.dol.gov/ui/data.pdf .

- The producer-price index rose 1.1% in the month of June and 11.3% from a year earlier.

- The EIA weekly oil report is here: http://ir.eia.gov/wpsr/wpsrsummary.pdf . Also, the EIA reported in the prior week:

- Field production of crude oil fell from 12.1MM BPD to 12.0MM BPD.

- Natural gas storage rose 58BN cubic feet and is below the 5-year average at this time of year.

- Baker Hughes reported the number of active oil rigs rose 2 to 599. The number of active natural gas was unchanged at 153.

- Factset reported that with 7% of S&P 500 companies reporting 2nd quarter earnings, the blended earnings increase is 4.2%.

Please call us if you have any questions.

Loren C. Rex, CFP®, MA Erik A Smith, AIF®

Founder / Emeritus President & C.E.O.

269-441-4143 517-795-2025

Registered Representative of and securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Generations Financial Planning & Wealth Management are separate companies and are not affiliated.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. The Indices mentioned are unmanaged and cannot be invested into directly.