Most major stock indices ended the volatile week with slight gains with the exception of the small cap Russell 2000 which ended the week down. Stocks sold off after the FED announcement as the FED statement and the press conference indicated there may be more work to be done on inflation. Market volatility was increased by Treasury Secretary Janet Yellen’s testimony to both the House and the Senate. On Wednesday she told Congress that the government is not considering blanket FDIC insurance on all deposits unless Congress acts to do this and markets sold off. On Thursday she said that the government is prepared to take more emergency actions like it did with Silicon Valley Bank and Signature Bank and the markets rebounded.

Treasury bond yields were mixed with the 30-year bond yield rising to 3.643% and the 10-Year note fall to 3.381%. Freddie Mac reported that 30-year mortgage rates fell to 6.42%. Crude oil rose to $69.25 a barrel and natural gas fell to $2.317 per MMBTUs. The U.S. dollar index fell to 103.13 and gold fell to $1978.80 an ounce.

- Canada reported

- Year over year inflation fell to 5.2% in February, down from 5.9% in January.

- Food price increases remain high at 10.6% from a year ago.

- Energy prices fell 0.6%.

- Excluding volatile food and energy prices rose 4.7%, down from 4.8% in January.

- It’s population grew from 38.5MM to 39.6MM in 2022.

- 96% of the growth was attributed to migration.

- Canada set a goal in increase immigration to solve it’s labor shortages.

- Year over year inflation fell to 5.2% in February, down from 5.9% in January.

- The U.K. reported that consumer prices were 10.4% higher than a year ago in February, up from 10.1% in January.

- For the month of January prices rose 1.1%.

- Most of the increase was due to restaurants, cafes, food and clothing.

- Recording media and motor fuels fell.

- The Bank of England met and raised the benchmark interest rate from 4.0% to 4.25%.

- Japan reported the smallest increase in consumer prices in five months.

- Overall prices rose 3.3% in February from a year earlier, down from 4.3% year over year in January.

- Core prices, excluding volatile food and energy were up 3.1%.

- Part of the reason for falling inflation were government subsidies starting for fuel and electricity. Prices for fuel, electricity and water actually fell.

- Food prices were up 7.5% year over year.

- Japan’s central bank has not moved to tighten its ultra loose monetary policy.

- The National Association of Realtors reported that existing home sales rose 14.5% in February, following 12 months of declines.

- From a year earlier, the median price of an existing home sold fell 0.2% to $363,000. This was down from a high of $413,800 in June and the first annual decline in 11 years.

- The Federal Reserve met and raised short term interest rates 0.25% to a range of 4.75% to 5.0%.

- The FED statement softened its language saying “additional policy firming may be appropriate” rather than forecasting “ongoing increases”.

- The statement categorized the US banking system as “sound and resilient” but acknowledged that the turmoil is “likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation”.

- Rather than saying inflation has eased, it now says it “remains elevated”

- FED Chair Powell said he’s prepared to hike rates further until inflation cools.

- The dot plot of FED members anticipation for rates continues to indicate that rate cuts are not likely this year, ending the year at 5.1% with cuts coming in 2024.

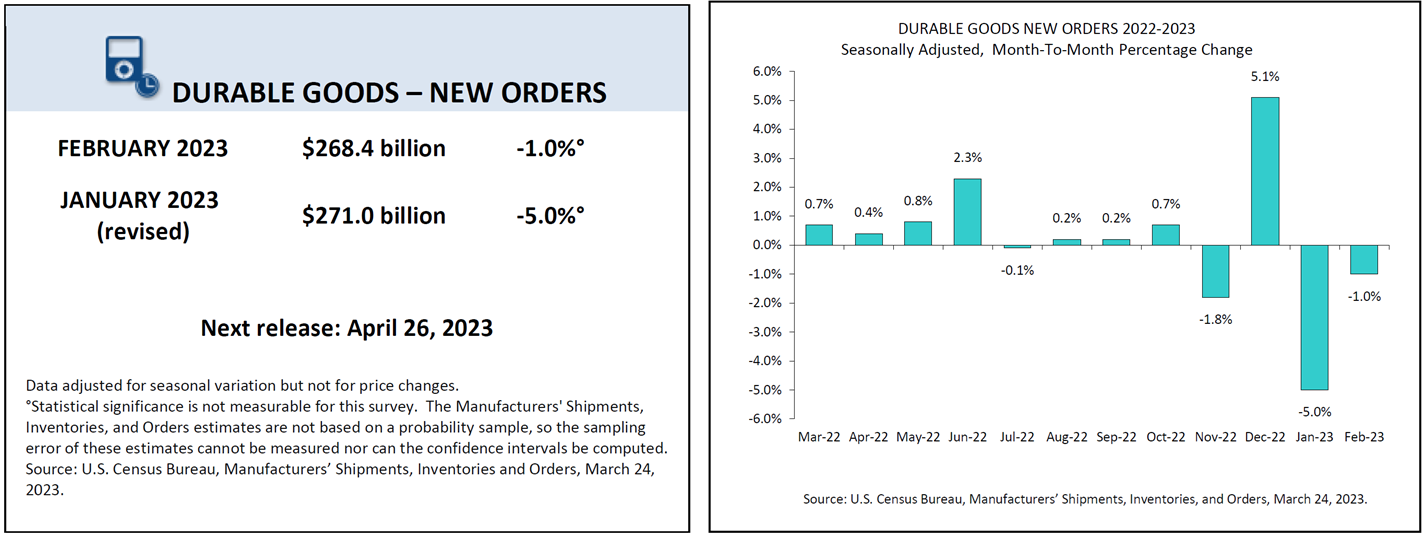

- The Commerce Department reported:

- The Labor Department reported:

- Seasonally adjusted first-time claims for unemployment were 191,000 down from 192,000 in the prior week.

-

-

- The 4-week moving average of claims, designed to smooth out volatility, was 196,250 down from 196,500 in the prior week.

- For the full unemployment report go here: https://www.dol.gov/ui/data.pdf .

-

- The EIA weekly oil report is here: http://ir.eia.gov/wpsr/wpsrsummary.pdf . Also, the EIA reported in the prior week:

- Field production of crude oil rose from 12.2MM BPD to 12.3MM BPD.

- Natural gas storage fell 72BN cubic feet and is above the 5-year average at this time of year.

- Baker Hughes reported the number of active oil rigs rose 4 to 593. The number of active natural gas rigs was unchanged at 162.

Please call us if you have any questions.

Thank you,

Loren C. Rex, CFP®, MA Erik A Smith, AIF®

Founder / Emeritus President & C.E.O. 269-441-4143 517-795-2025

Registered Representative of and securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Generations Financial Planning & Wealth Management are separate companies and are not affiliated.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. The Indices mentioned are unmanaged and cannot be invested into directly.