Stock indices ended the week mixed with developed foreign stocks posting modest gains and modest losses in the Dow Jones 30 Industrials.

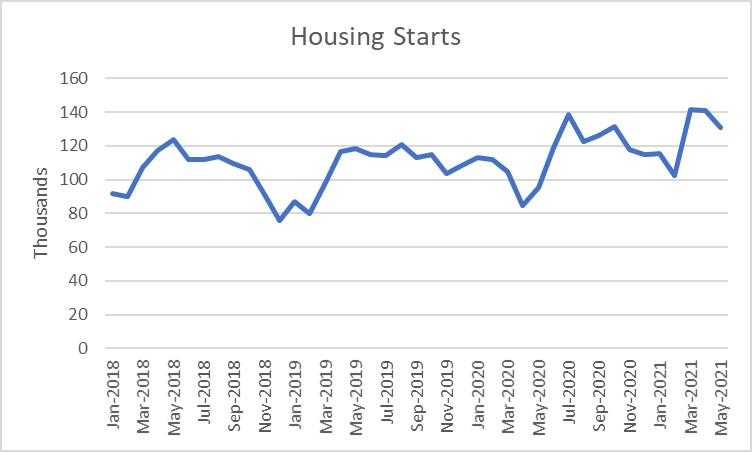

Stocks sold off Wednesday on weaker housing starts and the Federal Reserve’s April meeting minutes indicating that some FED officials want to discuss a plan to taper bond purchases in future meetings. While Federal Reserve Chairman, Jerome Powell, has repeatedly said that the FED is “not thinking about thinking about” removing support for the economy, such as tapering bond purchases, it is now clear that some at the FED think it is time to have that discussion. This does not mean that the taper of bond purchases will start any time soon or that there will be a hike in short term rates in the near future.

So far 21 states have decided to end the extra $300 per week in unemployment benefits prior to the expiration after September. Michigan is not one of them but is reinstating a requirement that recipients show they are searching for jobs.

This week China pledged to crack down on crypto currency miners and traders both because of the electricity usage to create it and the systemic risks posed by a volatile investment product authorities can’t control. The majority of crypto mining occurs in China and uses high power computer processing to solve complex calculations and “mine” the currency. China is considered to have the largest share of crypto mining and is concerned about its effect on power consumption as China wrestles with reducing its carbon emissions. It remains to be seen whether other countries will follow suit. As much criminal activity is conducted via cryptocurrency, which is hard for governments to trace, it may only be a matter of time.

Oil prices fell as news that the U.S. and Iran are nearing completion on an agreement to restart the Iran nuclear deal.

Treasury yields fell with the 30-year bond yield closing at 2.321% and the 10-Year note closing at 1.614%. Crude oil fell to $63.87 a barrel and natural gas fell to $2.904 per MMBTUs. The U.S. dollar index fell to 90.03 and gold rose to $1882.80 an ounce.

In the economic numbers this week:

- China reported:

- Industrial production was up 9.8% in April from a year earlier, down from 14.1% year over year in March.

- Retail sales were up 19.9% in April from a year earlier, down from 34.2% year over year in March.

- Fixed asset investment, in the first four months of the year, was up 19.9% from the same period last year.

- Japan’s gross domestic product shrank at a 5.1% annualized rate in the first quarter of 2021, after posting growth in the second half of 2020. A resurgence of Covid-19 was blamed for the contraction.

- The National Association of Realtors reported:

- Existing home sales fell 2.7% in the month of April, the third monthly decline due to a shortage of existing homes and a price surge. However, existing home sales were up 33.9% from a year earlier.

- The median price for an existing home sale was up 19.1% from a year earlier due to low supply.

- The Commerce Department reported:

- Housing starts fell 9.5% in April. The decline was attributed to supply chain constraints and higher materials costs.

- Permits, an indicator of future housing starts, rose 5% in April.

- The Labor Department reported:

- A seasonally adjusted 444,000 workers filed initial claims for unemployment in the week ending May 15th down from a revised 475,000 the week before.

- The 4-week moving average, designed to smooth out volatility, fell to 505,000.

- Continuing claims rose from 3.7MM to 3.8MM in the week ending May 8st.

- A broader measure of claims including extended benefits, pandemic assistance and other programs fell from 16.9MM to 16.0MM in the week ending May 1st.

- For the full unemployment report go here: https://www.dol.gov/ui/data.pdf .

- The EIA weekly oil report is here: http://ir.eia.gov/wpsr/wpsrsummary.pdf . Also, the EIA reported in the prior week:

- Field production of crude was unchanged at 11.0MM BPD.

- Natural gas storage rose 71BN cubic feet and is below the average level at this time of year during the past five years.

- Baker Hughes reported the number of active oil rigs rose 4 to 356. The number of active natural gas rigs fell 1 to 99.

Please call us if you have any questions.

Best Regards,

Loren C. Rex, CFP®, MA Erik A Smith AIF®

President Managing Partner

Generations Financial Planning & Wealth Management 269-441-4143

77 E. Michigan Ave, Suite 140

Battle Creek, MI 49017

Tel 269-441-4090

Carrie Fuce, Assistant 269-441-4091

Toll Free: 800-513-8180

Fax 866-381-2301

Visit our Website: www.genfinplan.com

Registered Representative of and securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Generations Financial Planning & Wealth Management are separate companies and are not affiliated.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. The Indices mentioned are unmanaged and cannot be invested into directly.