The Federal Reserve met and left its benchmark interest rate unchanged. Chair Jerome Powell said that it will take longer than previously expected for the FED to gain enough confidence the inflation trajectory to start cutting rates. The PMI releasees and jobs number released last week do point to a slowing economy in April which traders believe will lead to slower inflation causing a rally Thursday and Friday.

Colombia’s central bank cut its benchmark interest rate half a percent to 11.75%.

Treasury bond yields fell with the 30-year bond yield at 4.663% and the 10-Year note at 4.502%. Freddie Mac reported that the average 30-year mortgage rate rose to 7.22%. Crude oil fell to $78.13 a barrel and natural gas rose to $2.146 per MMBTUs. The U.S. dollar index fell to 105.04 and gold fell to $2310 an ounce.

In economic reports this week:

- Canada’s gross domestic product grew 0.2% in the month of February after gaining 0.5% in January.

- S&P Global released its manufacturing purchasing manager’s indices for April. Keep in mind that anything over 50 represents expansion and anything under 50 represents contraction.

- U.S. manufacturing PMI fell from 51.9 to 50.0.

- Canada manufacturing PMI fell from 49.8 to 49.4.

- Japan manufacturing rose from 48.2 to 49.6.

- Eurozone manufacturing fell from 46.1 to 45.7.

- Mexico manufacturing fell from 52.2 to 51.0.

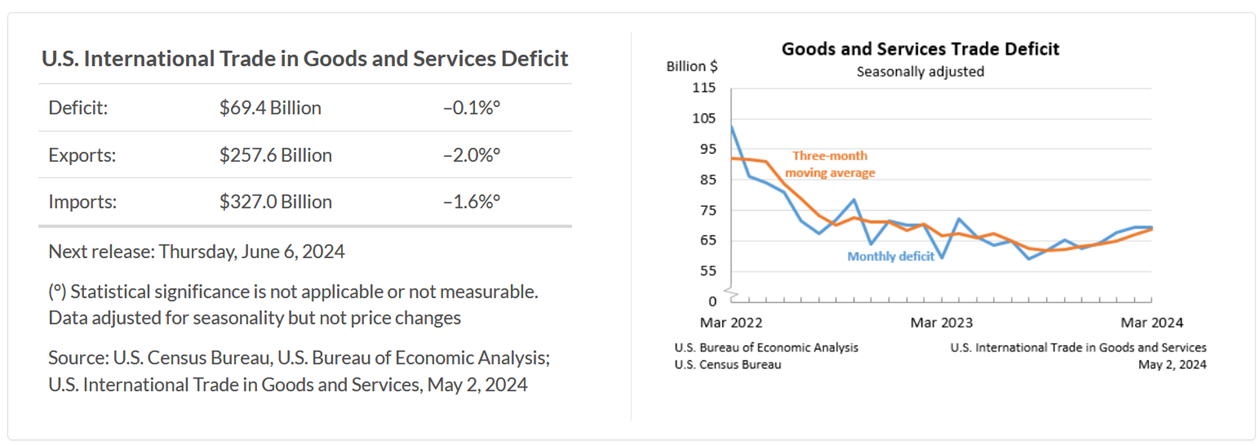

- The Commerce Department reported:

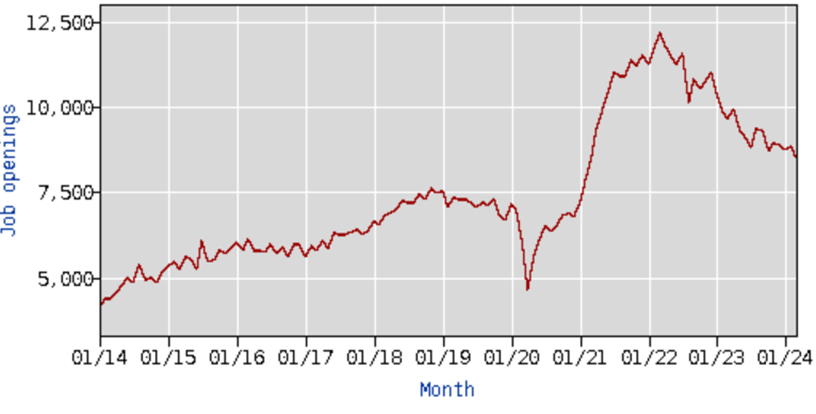

- The Labor Department reported:

Source: U.S. Department of Labor Statistics

-

- Non-farm productivity rose 0.3% in the first quarter and 2.9% from the first quarter of 2023.

- Output increased 1.3%.

- Hours worked increased 1.0%.

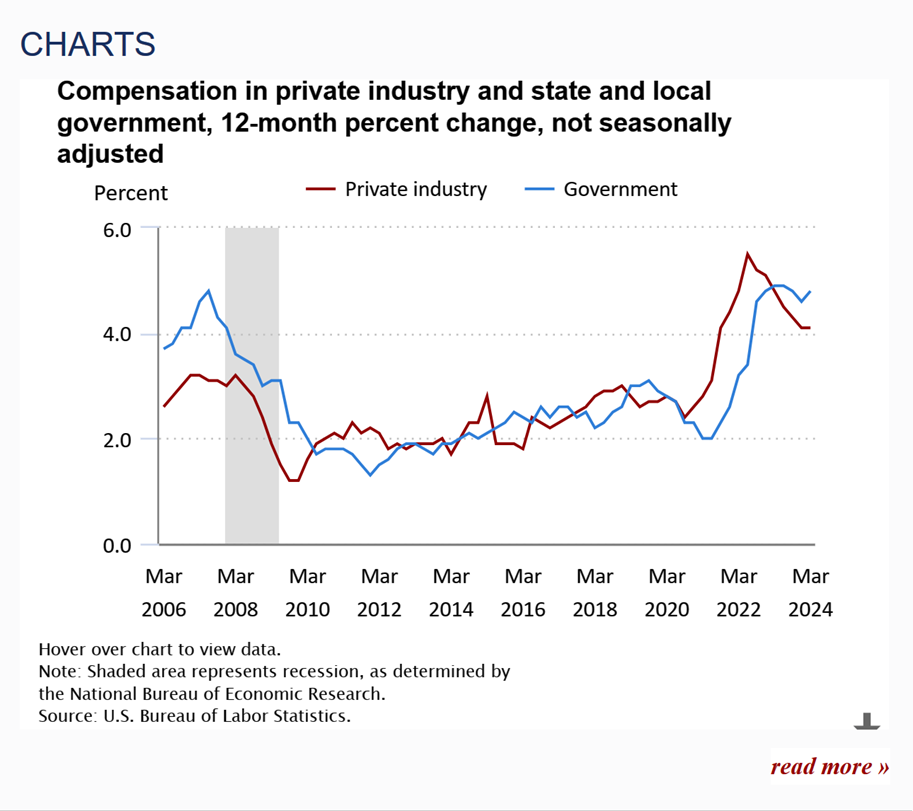

- Unit labor costs rose 4.7% in the first quarter and 1.8% from a year ago.

- Seasonally adjusted first-time claims for unemployment were 208,000, unchanged from the previous week’s revised level.

- The 4-week moving average of claims, designed to smooth out volatility, was 213,250, an increase of 250 from the previous week’s revised level.

- For the full unemployment report go here: https://www.dol.gov/ui/data.pdf .

- The U.S. added 175,000 jobs in April, the smallest gain in six months.

- February was revised to a gain of 236,000 jobs and March was revised to 303,000.

- The unemployment rate rose from 3.8% to 3.9% in April.

- The average hourly wage increased 0.2% in April and is up 3.9% from a year ago.

- Non-farm productivity rose 0.3% in the first quarter and 2.9% from the first quarter of 2023.

- The EIA weekly oil report is here: http://ir.eia.gov/wpsr/wpsrsummary.pdf . Also, the EIA reported in the prior week:

- Field production of crude oil was unchanged at 13.1MM BPD.

- Natural gas storage rose 59BN cubic feet and was above the highest level during the past five years at this time of year.

- Baker Hughes reported the number of oil rigs fell 7 to 499 and the number of natural gas rigs fell 3 to 102.

- Factset reported that with 80% of S&P 500 companies reporting, the blended earnings increase so far is 3.4% from a year ago.

Please call us if you have any questions.

Loren Rex – Emeritus

Erik A Smith, AIF® – President & C.E.O.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. The Indices mentioned are unmanaged and cannot be invested into directly. The Dow Jones Industrial Average, Dow Jones, or simply the Dow, is a stock market index of 30 prominent companies listed on stock exchanges in the United States. The DJIA is one of the oldest and most commonly followed equity indexes. The Nasdaq Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange (more than 2500 stocks).

Sources:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

https://ir.eia.gov/ngs/ngs.html

https://www.freddiemac.com/pmms

https://www.wsj.com/market-data?mod=nav_top_subsection

https://bakerhughesrigcount.gcs-web.com/na-rig-count

https://www.census.gov/economic-indicators

https://insight.factset.com/topic/earnings